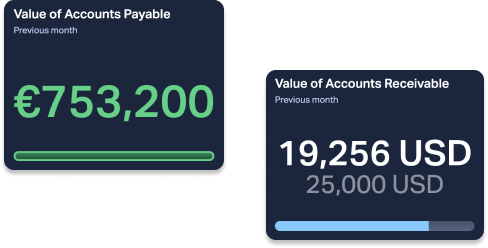

Customers can buy items on credit score, and the retailer will maintain track of the outstanding steadiness. This means guaranteeing that invoices are despatched out in a timely manner, following up on overdue funds, and negotiating favorable fee phrases with suppliers. The primary distinction between accounts receivable and accounts payable is that one is an asset and the opposite is a liability.

By permitting customers to buy items or providers on credit score, corporations can improve their gross sales volumes and buyer loyalty by offering versatile cost terms. The accounts receivable process involves invoicing clients for items or services that have been delivered, pursuing cost and then processing and recording cost. For many businesses, accounts receivable are sometimes a key component of working capital. Since they characterize a company’s right to receive cash in the near future, accounts receivable are thought-about an asset quite than a liability.

- That is, they deliver the products and providers immediately, send an bill, then get paid a couple of weeks later.

- Set up totally different automation rules primarily based on fee history, invoice amounts, or customer relationships.

- As accounts receivable are a half of this category, they contribute to the company’s financial flexibility and ability to cowl short-term obligations.

- It is taken into account one of the liquid belongings, second only to cash and cash equivalents.

Nonetheless, accounts receivable is not only restricted to customers, but also extends to suppliers. A lower DSO is generally seen as a optimistic signal, indicating that a company is collecting payments extra shortly. The common accounts receivable is calculated by adding the beginning and ending accounts receivable for a interval and dividing by two. This allowance represents the estimated quantity of accounts receivable which will turn out to be uncollectible sooner or later. Monitoring the aging schedule of receivables is crucial to keep observe of outstanding invoices.

Resellers and producers, for instance, typically need to make credit-based purchases to obtain the uncooked materials required to generate later profits. Conversely, with the best policies in place, you’ll have the ability to recognize safer bets that you might have beforehand ignored. Environment Friendly management of AR can ensure a gentle cash move, smooth operations, and decreased chances of financial instability.

A retail enterprise tends to have the next proportion of payables, since it’s buying its primary input from suppliers (merchandise). Accounts receivable is an accounting time period that displays the funds owed to your corporation by customers who’ve already acquired an excellent or service but have not yet paid for it. Unless you require superior funds or take care of cash on delivery (COD) gross sales only, you must document these credit-based transactions as A/R within your common ledger and company stability sheet. Accounts receivable is any amount of money https://www.simple-accounting.org/ your prospects owe you for items or providers they purchased from you up to now.

Trade Receivables

A company with efficient credit policies and robust assortment processes is more likely to keep a healthy A/R balance and convert it into money quickly. For instance, a manufacturing firm providing 30-day credit phrases could attract bigger orders from prospects who recognize the flexibility of deferred funds. Nonetheless, extending credit score also comes with risks, as delayed or defaulted funds can strain money circulate and scale back profitability. When the client pays his bill, Freidman would document the fee by debiting cash and crediting the receivables account. This means the A/R stability is cleared out and the revenues recorded equals the cash acquired. Unfortunately, not all your prospects can pay their debts promptly, which means you’ll probably need to do some chasing to recuperate those excellent funds.

Fee Gateway

It presents sturdy automated workflows for bill entry, approval, and payment scheduling, with seamless integrations with major accounting software program like QuickBooks and NetSuite. These give insight into the state of their accounts and enable them to manage them in a quick and correct method. As Quickly As a company delivers a great or service, accounts receivable professionals must now bill the shopper for the quantity owed. This could also be both a paper invoice despatched through the mail, or increasingly, via ePresentment or electronic billing. Electronic invoices embody older codecs corresponding to faxes and telephone (interactive voice response). Newer, extra environment friendly formats embody emailed payments and bills offered via portals.

Invoiced

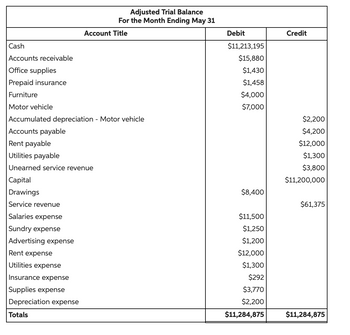

Calculating your business’s accounts receivable turnover ratio is certainly one of the finest methods to maintain observe of late payments and ensure they aren’t getting out of hand. Accounts receivable appears in your company’s balance sheet beneath the current property section, usually listed right after money and cash equivalents. These are quantities you anticipate to transform to cash inside 1 12 months, alongside cash, short-term investments, and inventory in your working capital cycle. You’ve simply delivered an amazing services or products to a client, they’re thrilled with the results, and you have despatched over the invoice.

Then don’t hesitate to implement them, even if it means turning down a couple of people within the short term. Accounts receivable encompasses all amounts owed to a enterprise, ranging from traditional credit sales to numerous earnings streams. This scenario completely illustrates how accounts receivable affects cash circulate. Sarah technically owns that $50,000, but it’s tied up until her shopper pays. She would possibly need to delay paying her freelancers or draw funds from a credit line to cover expenses.

This instance demonstrates why the question of whether accounts receivable are an asset is answered affirmatively. Thus, to find a way to report an accounts receivable journal entry for a sale to a customer, we’d debit AR and credit score sales. At the tip of the year, the AR T-account is added up and transferred to the monetary statements. Yes, HighRadius seamlessly integrates with main ERP platforms like SAP, Oracle, and NetSuite. This ensures real-time data synchronization, reduces manual knowledge entry, and keeps accounts receivable processes aligned together with your current financial workflows. AI enhances accounts receivable automation by offering intelligent prioritization of collection efforts, predictive analytics for fee habits, and automatic cash software.

Accounts receivable are generally paired with the allowance for uncertain accounts (a contra account), during which is stored a reserve for unhealthy money owed. The combined balances in the accounts receivable and allowance accounts represent the net carrying value of accounts receivable. A sample presentation of accounts receivable within a stability sheet appears within the following exhibit.

Deixe um comentário