In the Zeus Versus Hades slot, you’ll discover multiple ways to win, thanks to its versatile setup and immersive features. The game offers thrilling elements like avalanche reels and wilds that enhance your chances of hitting wins. With multiple bonus features, such as bonus spins and multiplier features, you may find yourself planning on how to optimize your potential payouts. But how can you best utilize these mechanics to enhance your overall game experience?

Understanding the Game Mechanics

When you dive in the Zeus vs. Hades slot, you’ll quickly discover that ibisworld.com comprehending the game mechanics is essential for enhancing your experience and potential winnings.

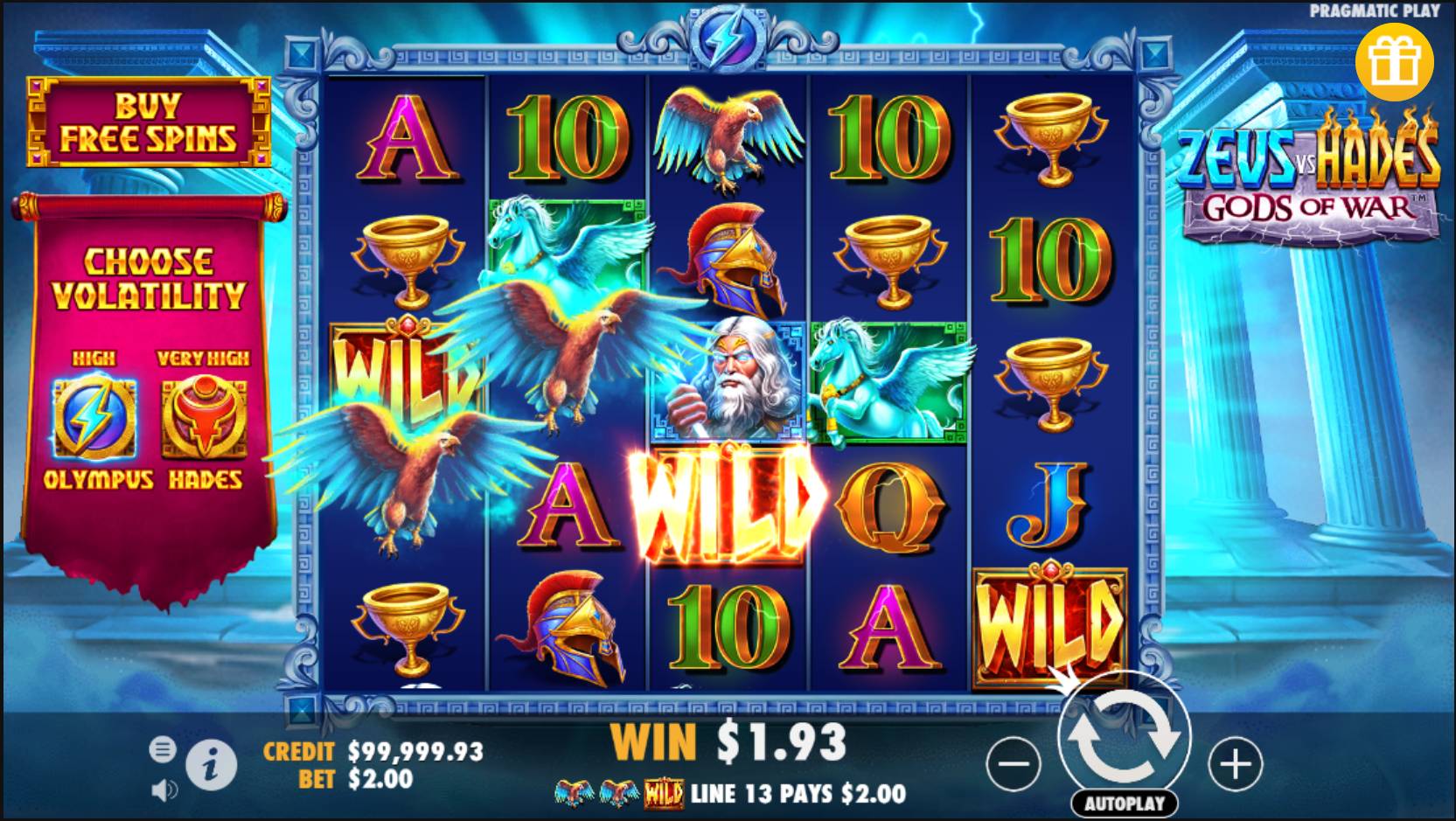

The game features 5 reels and multiple paylines, allowing for varied winning combinations. You’ll want to become familiar with the symbols; watch for the wild symbols that stand in for others, boosting your chances.

Pay attention to the bonus features that can trigger complimentary spins or multiplier bonuses, boosting your payouts. It’s also important to grasp the return to player (RTP) percentage; knowing this helps formulate realistic expectations.

As you delve deeper, keep track of your wagering strategy to enhance how you play the game and raise your odds of success.

Exploring the Cascading Reels Feature

In Zeus vs. Hades, the Avalanche Reels feature can greatly boost your gameplay experience.

As symbols fall into place and winning combinations are removed, new symbols take their place, potentially leading to several wins in a single spin.

Cascading Reels Mechanism Explained

While many players value the thrill of classic slot games, the cascading reels mechanism in Zeus vs. Hades takes the excitement to a new height. zeusvshades.org

Instead of just spinning and stopping, cascading reels allow winning combinations to vanish, paving the way for new symbols to fall into place. This process can create multiple wins from a single spin, boosting engagement and potential payout.

You’ll notice how each win triggers a chain reaction, with symbols continually cascading into place. This feature not only increases anticipation but also incorporates strategy; understanding when to capitalize on these opportunities can boost your gameplay.

Mastering the cascading reels will certainly give you an edge, altering each session into a thrilling experience filled with potential surprises.

Impact on Winning Potential

Understanding how cascading reels influence your winning potential can greatly augment your gaming strategy in Zeus Vs Hades. When winning combinations occur, the symbols involved disappear, allowing new symbols to cascade down and create additional winning opportunities.

This feature not only boosts your chances of multiple wins in a single spin but also increases the excitement of each round.

And, the potential for successive multipliers can lead to significant payouts. The cascading nature encourages strategic betting, as you might want to bet more when on a winning streak.

Unlocking Free Spins

Revealing free spins in the Zeus Vs Hades slot can greatly enhance your gaming experience and increase your winning potential.

Understanding how to access these spins is vital for enhancing your gameplay. Here are key elements to ponder:

- Collect special symbols to activate free spins

- Anticipate wilds that can improve your free spin chances

- Keep an eye on scatter symbols, as they’re fundamental

- Know the specific requirements for each spin type

- Monitor your balance; free spins keep your bankroll active

Bonus Features and How They Work

Exploring the bonus features in the Zeus Vs Hades slot can greatly enhance your overall gaming experience, making each spin more thrilling.

These features typically include Free Spins, Bonus Games, and multipliers, which boost your chances of winning. When triggered, Free Spins allow you to spin the reels without wagering additional credits, maximizing your potential payout.

Bonus Games often introduce unique challenges or mini-games that can yield substantial rewards, enhancing both excitement and engagement. Additionally, multipliers can amplify your winnings during specific features or spins.

Understanding how these elements interact with base gameplay is key; strategically utilizing them can help you influence your odds, giving you a clearer path to mastering this lively slot experience.

The Role of Wild Symbols

In addition to the exciting bonus features like Free Spins and multipliers, wild symbols play a crucial role in enhancing your experience in the Zeus Vs Hades slot.

These special icons can substitute for other symbols, making it easier to form winning combinations. Here’s how they can maximize your play:

- Enhance winning potential by filling in gaps in your combinations.

- Create additional pay lines by converting ordinary symbols into more lucrative ones.

- Activate bonus features in certain scenarios, granting you more ways to win.

- Extend gameplay by triggering free spins when paired with other features.

- Bring an element of excitement, sparking anticipation with every spin.

Understanding wild symbols is crucial for mastering your Zeus Vs Hades gameplay.

Maximizing Your Bet Strategies

To truly enhance your chances in Zeus Vs Hades, understanding and maximizing your bet strategies is essential.

Start by reviewing your bankroll and setting a budget; this assists you prevent unnecessary losses. Think about modifying your bet size based on the game’s volatility. Higher bets can produce bigger wins but come with increased risk.

Employ a reliable betting strategy, whether flat betting or raising bets after losses. Pay attention to the paytable—knowing which symbols have the best return can impact your bet placement.

Additionally, take advantage of bonuses and promotions, but always read the terms. The right strategy isn’t just about luck; it’s about making informed choices that align with your gaming style for best outcomes.

Tips for Responsible Gaming

While experiencing Zeus Vs Hades, keeping your gaming experience fun and safe is essential.

Practicing responsible gaming not only boosts your enjoyment but also assists you avoid potential pitfalls. Here are some tips to ensure you stay in control while playing:

- Set a budget before you start and stick to it.

- Decide on a time limit for your gaming session.

- Avoid chasing losses; remember it’s a game of chance.

- Take regular breaks to clear your mind.

- Play for entertainment, not as a way to make money.

Frequently Asked Questions

Can I Play Zeus Vs Hades Slot on Mobile Devices?

Yes, you can play Zeus vs Hades slot on mobile devices. The game’s mobile compatibility ensures an engaging experience, so you won’t miss out on any thrilling features, graphics, or gameplay, no matter where you are.

What Are the Minimum and Maximum Bets Allowed?

When it comes to bets in slot games, the minimum and maximum limits can vary considerably. You should check the specific game rules to find your optimal betting range for boosting potential wins.

Is There a Demo Version Available to Practice?

Yes, there’s a demo version available for practice. You can acquaint yourself with the game mechanics without risking your funds, which assists you strategize effectively and increase your confidence before playing for real money.

Are There Any Jackpots in Zeus Vs Hades Slot?

Certainly, there are jackpots in Zeus Vs Hades slot. You’ll find various types, including fixed and progressive ones, enhancing your gameplay experience. Keep an eye out for features that can increase your chances of winning big!

How Do I Know When to Stop Playing?

Knowing when to stop playing is important. Set a budget before you start, and stick to it. If you’re failing consistently, feeling frustrated, or reaching your limit, it’s time to step back and reset.